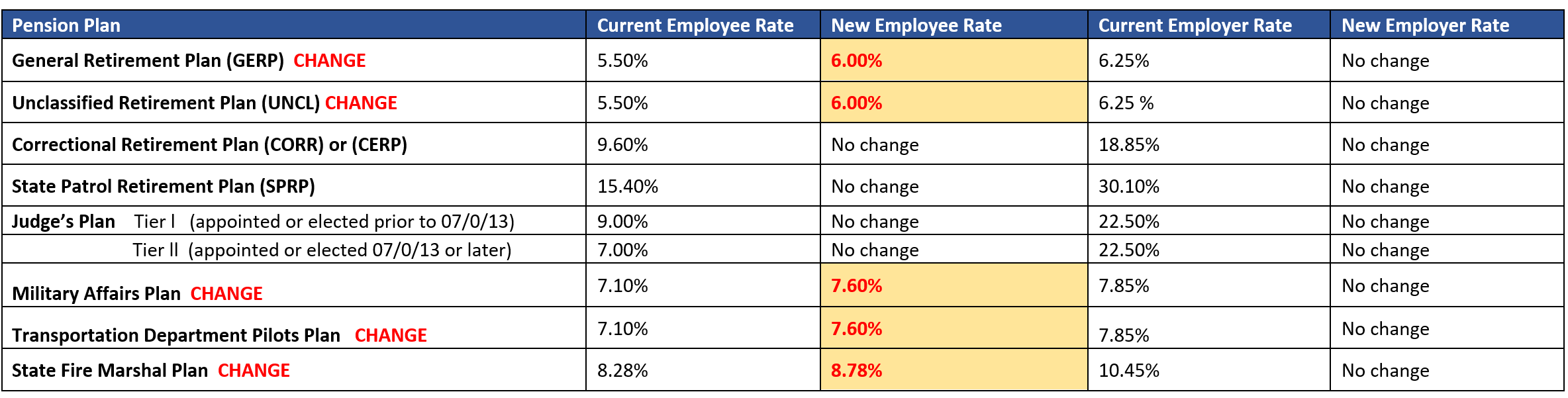

Contributions effective the first full 80-hour pay period in July 2025

Current Contributions - percent of pay

The amounts are a percent of gross income. It is determined by state statute and is subject to change.

|

MSRS Retirement Plan |

Employee |

Employer |

Employer Supplemental Increase1 |

|---|---|---|---|

|

General Employee Retirement Plan |

5.50% |

6.25% |

|

|

Correctional Employees Retirement Plan |

9.60% |

14.40% |

4.45% |

|

State Patrol Retirement Plan |

15.40% |

23.10% |

7.00% |

|

Unclassified Retirement Plan |

5.50% |

6.25% |

|

|

Judges Plan - Tier 1: hired prior to July 1, 2013 |

9.00% |

22.50% |

|

|

Judges Plan - Tier 2: hired July 1, 2013 of after |

7.00% |

22.50% |

|

|

Military Affairs Plan |

7.10% |

7.85% |

|

|

Transportation Department Pilots |

7.35% |

7.475% |

|

|

State Fire Marshals Plan |

8.28% |

10.45% |

|

|

Legislators |

9.00% |

* |

1Starting July 1, 2021. The employer supplemental increase will cease upon attainment of 100% funding status or the end

of the 30-year amortization period, whichever is earlier.

*Legislators employer contributions: an appropriation is paid to the retirement system annually when the member retires.